Please refer to important disclosures at the end of this report

1

Muthoot Finance

Gold at ‘work’

IPO Note

|

Banking

April 18, 2011

Organized gold lending - a fast-growing and highly profitable niche:

Organized gold loan NBFCs have grown at a tremendous rate of 76.2% CAGR

over FY2007-10 and a reasonably large potential market still remains, considering:

a) even as of FY2010, ~75% of the total market is with the unorganized money

lenders and pawnshops (Source: RHP, CRISIL), b) relatively lower rates of interest

and higher trust factor than unorganized players, c) increasing reach due to rapid

branch expansion, d) fast and convenient service and e) increasing acceptability of

gold loans aided by heavy advertising. Further, as of FY2010 only ~4.7% of India’s

gold holding is pledged for gold loans, highlighting further potential for future

growth. Moreover, small-ticket gold loans are a highly profitable niche, as the

target market for gold loan NBFCs are mainly un-banked customers and credit

costs are also low due to the gold collateral.

Leading organized player with proven track record: Muthoot Finance Ltd.

(MFL) has capitalized on this opportunity, growing its AUM at 93.8% CAGR over

FY2008-8MFY2011 (~20% organized market share as of FY2010 as per IMaCS

Industry Report). This growth has been underpinned by a strong branch network

through rapid expansion (56.5% CAGR over FY2008-11MFY2011), a strong and

trusted brand which has enabled swift customer acquisition, fast and convenient

service and relatively more flexible products than banks.

Outlook and Valuation: While gold loan NBFCs like MFL have seen highly

profitable growth so far, this has occurred in an environment of consistently rising

gold prices. Any sharp decline in gold prices could pose downside risks to growth

and asset quality. Moreover, recent developments regarding lending to relatively

low-income segments have highlighted regulatory risks to MFL’s business from

any regulatory capping of its currently high yields (~19% in 8MFY2011). That

said, post-correction, MFL’s closest competitor Manappuram (MGF) is trading at

1.8x FY2013E BV (Bloomberg consensus) and MFL has been priced equivalent to

MGF’s valuations at the upper end of the price band. Considering the reasonably

high growth potential and profitability, we expect moderate upsides at the upper

band, also taking into account MFL’s higher market share than MGF, better

operating efficiency, higher leverage and a more extensive pan India branch

network. Hence we recommend a Subscribe to the issue at the upper price band.

Key financials

Y/E March (` cr) FY2010 FY2011E

FY2012E

FY2013E

NII

604 1,173

1,831

2,196

% chg

103.6

94.4

56.0

19.9

Net profit

229 471

777

906

% chg

133.5

105.9

65.1

16.6

NIM (%)*

11.1 10.0

9.3

8.2

EPS (`)

7.6 14.7

20.9

24.4

P/E (x)

#

23.1 11.9

8.4

7.2

P/ABV (x)

#

9.4 4.4

2.3

1.8

RoA (%)*

3.5 3.6

3.5

3.0

RoE (%)

48.3 49.7

36.5

26.9

Source: RHP, Angel Research. Note:

#

Valuations at the upper price band, *Calculated on total

assets includin

g

bilateral assi

g

nments

SUBSCRIBE

Issue Open: April18, 2011

Issue Close: April 21, 2011

Issue Details

Face Value: `10

Present Eq. Paid-up Capital: `320.2cr

Offer Size: 5.15cr Shares

Post Eq. Paid-up Capital: `371.7cr

Issue size (amount):** `824-901cr

Price Band: `160-175

Post-issue implied mkt cap**: `5,947cr-

6,505cr

Promoters holding Pre-Issue: 93%

Promoters holding Post-Issue: 80.1%

Note: **At the lower and u

p

per price band,

respectively

Book Building

QIBs Up to 50%

Non-Institutional At least 15%

Retail At least 35%

Post Issue Shareholding Pattern

Promoters Group 80.1

MF/Banks/Indian

FIs/FIIs/Public & Others

19.9

Vaibhav Agrawal

022 – 3935 7800 Ext: 6808

Shrinivas Bhutda

022 – 3935 7800 Ext: 6845

Varun Varma

022 – 3935 7800 Ext: 6847

Muthoot Finance

|

IPO Note

A

pril 18, 2011

2

Company background

MFL is India’s largest gold financing company (as of FY2010) in terms of loan

portfolio, as per IMaCS Industry Report. MFL is a Systemically Important Non-deposit

taking NBFC (NBFC-ND-SI) engaged in providing personal and business loans

secured by gold jewelry, primarily to individuals who possess gold jewelry but do not

have access formal credit within a reasonable time, or to whom credit may not be

available at all, to meet unanticipated or other short-term liquidity requirements.

According to the IMaCS Industry Report, as of FY2010 MFL’s branch network of

1,605 branches was the largest among gold loan NBFCs in India. The branch

network has been expanded to 2,611 branches as of February 2011 (it has further

grown to 2,749 branches as of April 15, 2011 as per MFL website). MFL has a

strong customer base as evident in ~4.1 million loan accounts as of 8MFY2011.

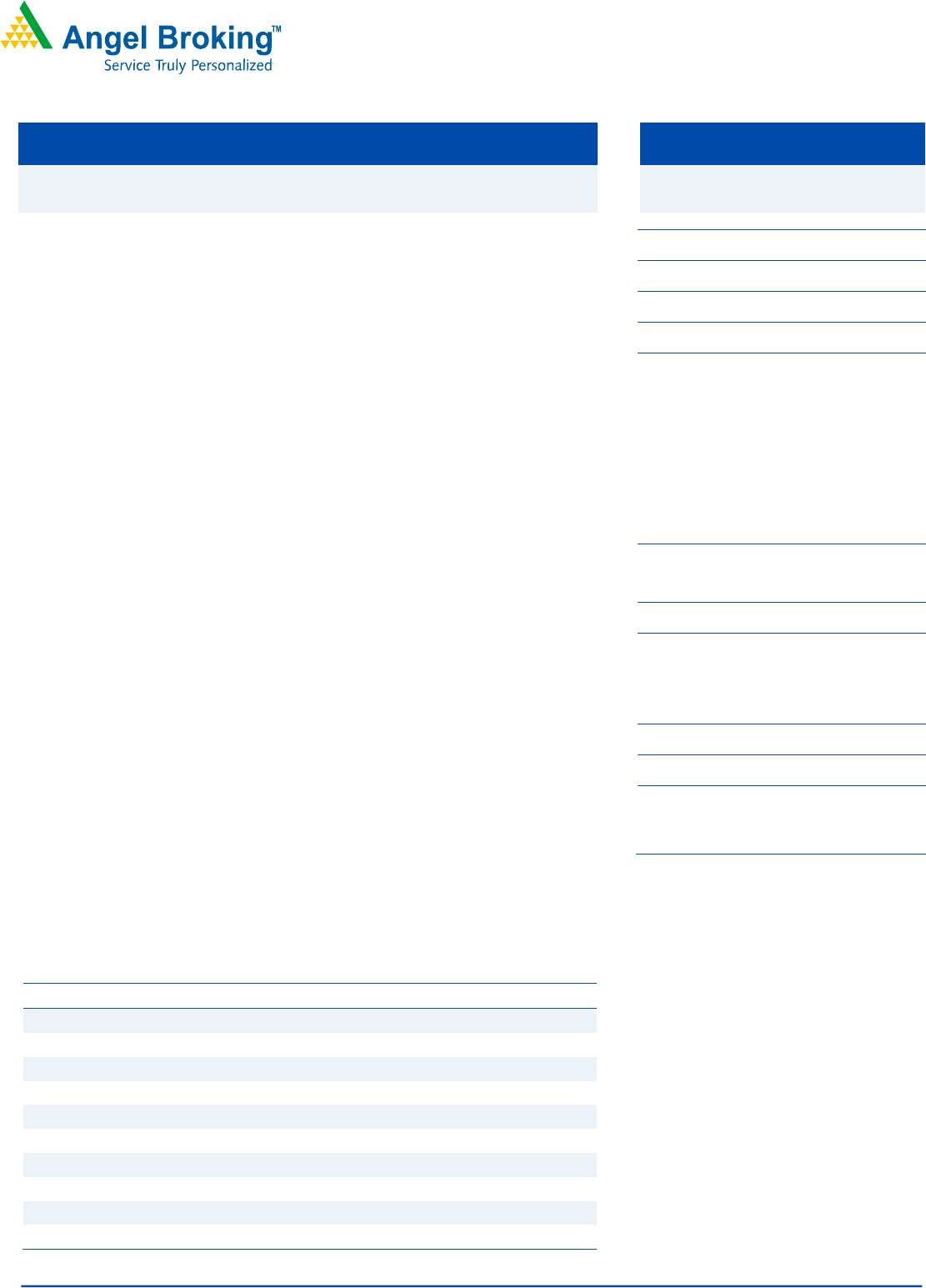

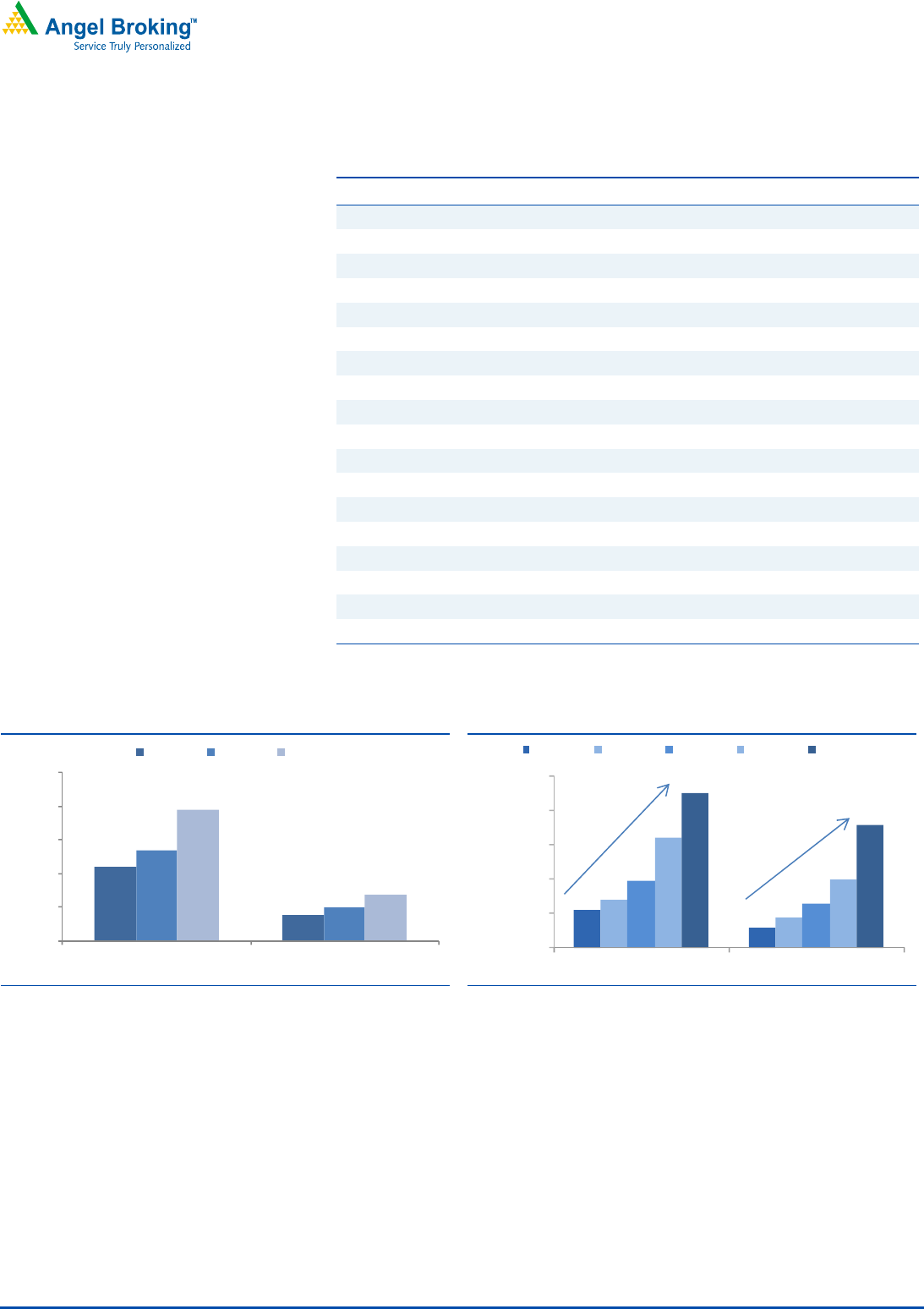

Exhibit 1: Rapid Branch Expansion

707

985

1,605

2,611

-

500

1,000

1,500

2,000

2,500

3,000

FY2008 FY2009 FY2010 11MFY11

No of Branches

Source: RHP, Angel Research

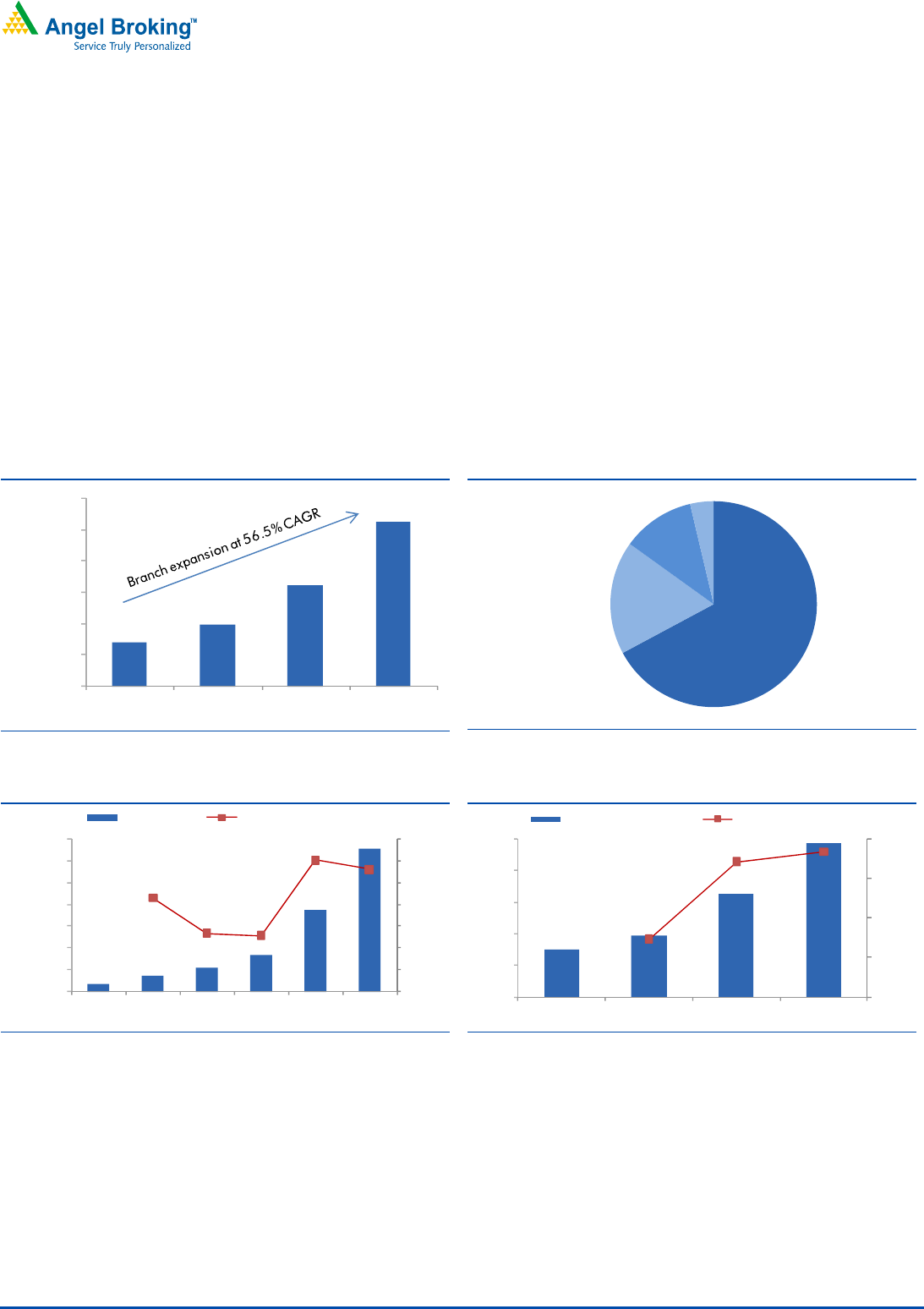

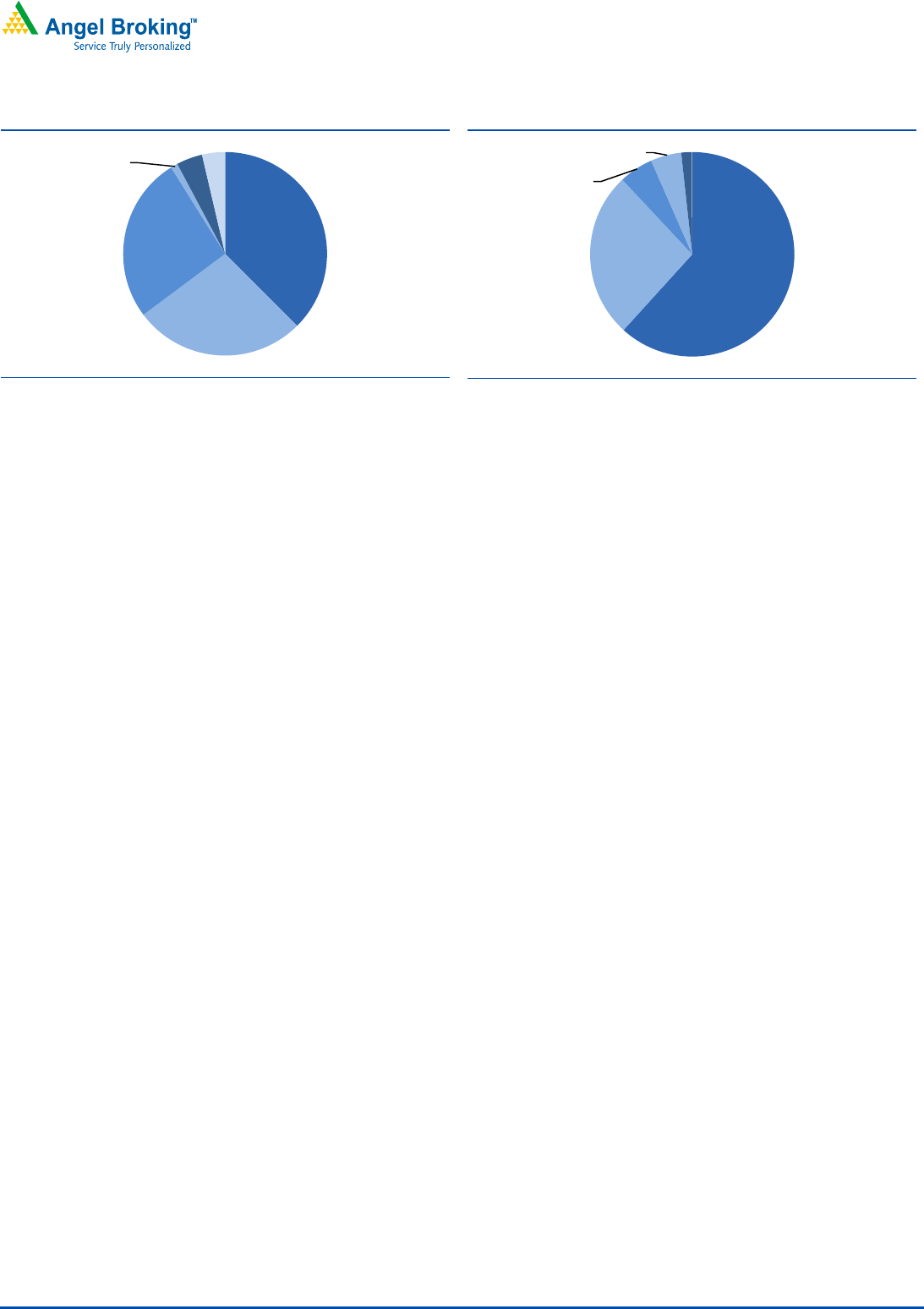

Exhibit 2: Strong branch network in Southern India

Southern India

67%

Northern India

18%

Western India

11%

Eastern India

4%

Source: RHP, Angel Research

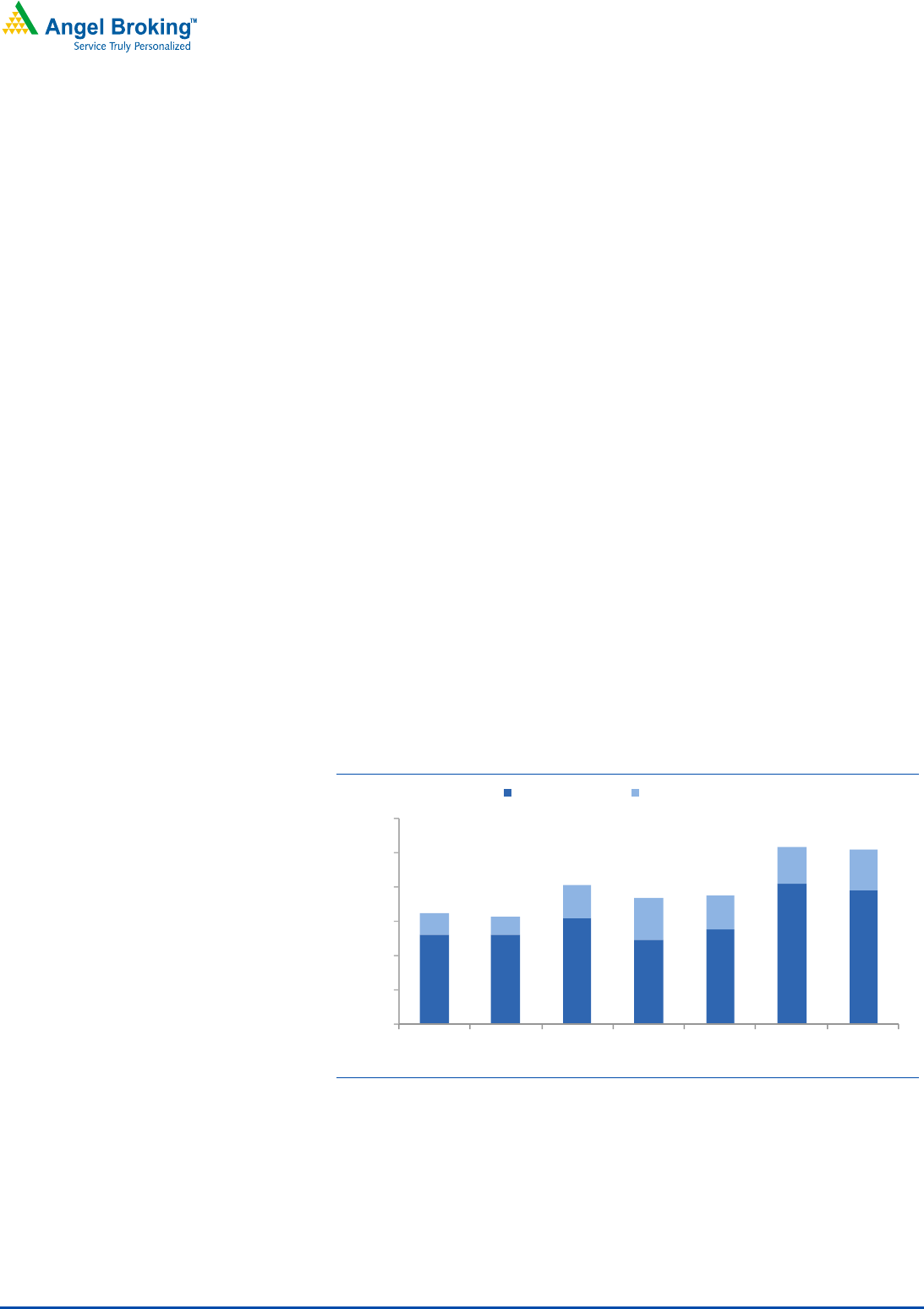

Exhibit 3: Strong AuM growth over past 2 years…

780

1,451

2,226

3,369

7,438

13,004

86

53

51

121

112

-

20

40

60

80

100

120

140

-

2,000

4,000

6,000

8,000

10,000

12,000

14,000

FY2006 FY2007 FY2008 FY2009 FY2010 8MFY11*

AuM (` cr) YoY growth (%,RHS)

Source: RHP, Angel Research; Note: growth for 8MFY11 annualized

Exhibit 4: …led primarily by volume growth

30 39 66 98

29.2

68.4

73.5

0

20

40

60

80

-

20

40

60

80

100

FY2008 FY2009 FY2010 8MFY11*

Gold volume (Tonnes) YoY growth (%,RHS)

Source: RHP, Angel Research; Note: growth for 8MFY11 annualized

Details of the issue

The IPO comprises an issue of 5.15cr equity shares of face value of `10 each in

the price band of `160–175 per share. The company expects to raise between

`824cr and `901cr at the lower and upper price band, respectively. The primary

issue of shares would result in a dilution of the promoter’s holding by 12.88% to

80.12%. The issue proceeds are planned to be utilized for augmenting the capital

base to meet future capital requirements, to provide for funding of loans to

borrowers; and for general corporate purposes.

Muthoot Finance

|

IPO Note

A

pril 18, 2011

3

Organized gold lending - a fast-growing and highly

profitable niche

Indian gold loan market – an overview

Indian gold loan market has historically been predominantly controlled by the

unorganized sector (accounting for ~75% of the total market according to the

IMaCS Industry Report as of FY2010) comprising of local money lenders and

pawnshops, which is highly fragmented, charge exorbitant rates, and often carry a

social stigma associated with borrowing from them. The competitive edge for

lenders in the unorganized sector lies in their ability to provide funds with

minimum documentation, quick and hassle-free disbursement of loans.

The gold loan market in India is under-penetrated considering the abundant

availability of gold as collateral with Indian private households (~17,500 tons or

10% of world’s gold stock, according to the World Gold Council (WGC), valued at

over `27,40,000cr as of FY2010) and the existing size of the gold loan market

(~`37,500cr for organized sector and ~`1,12,500cr for unorganized sector).

Further Indian households add ~700 tons to this holding each year of which

~75% is in the form of jewelry and this is expected to rise to ~1,200 tons by

CY2020 according to the WGC. However, this penetration data has to be

considered in the context of the likely concentration of gold holdings with high net

worth individuals, perception of it being the last resort financing and the social

stigma often attached to gold loans.

According to the IMaCS industry report, organised gold loan market size has

grown significantly over the past decade growing at a healthy CAGR of ~40.3%

during FY2002-FY2010 and has gained further momentum with CAGR of 46.2%

during FY2007-FY2010 to ~`37,500cr. During this period, growth in NBFCs was

much higher at 72% while the portfolio of MFL grew at a CAGR of 73%.

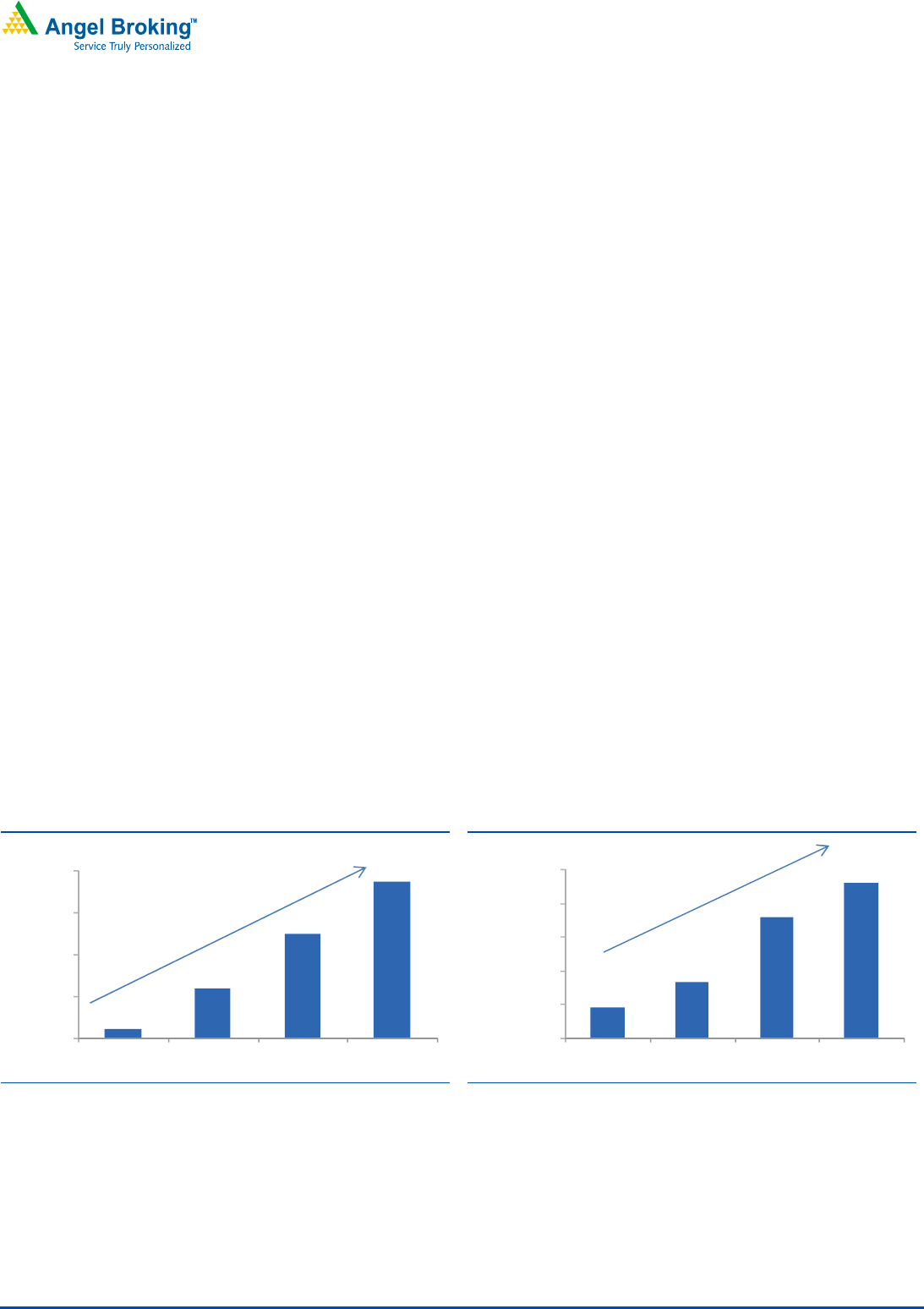

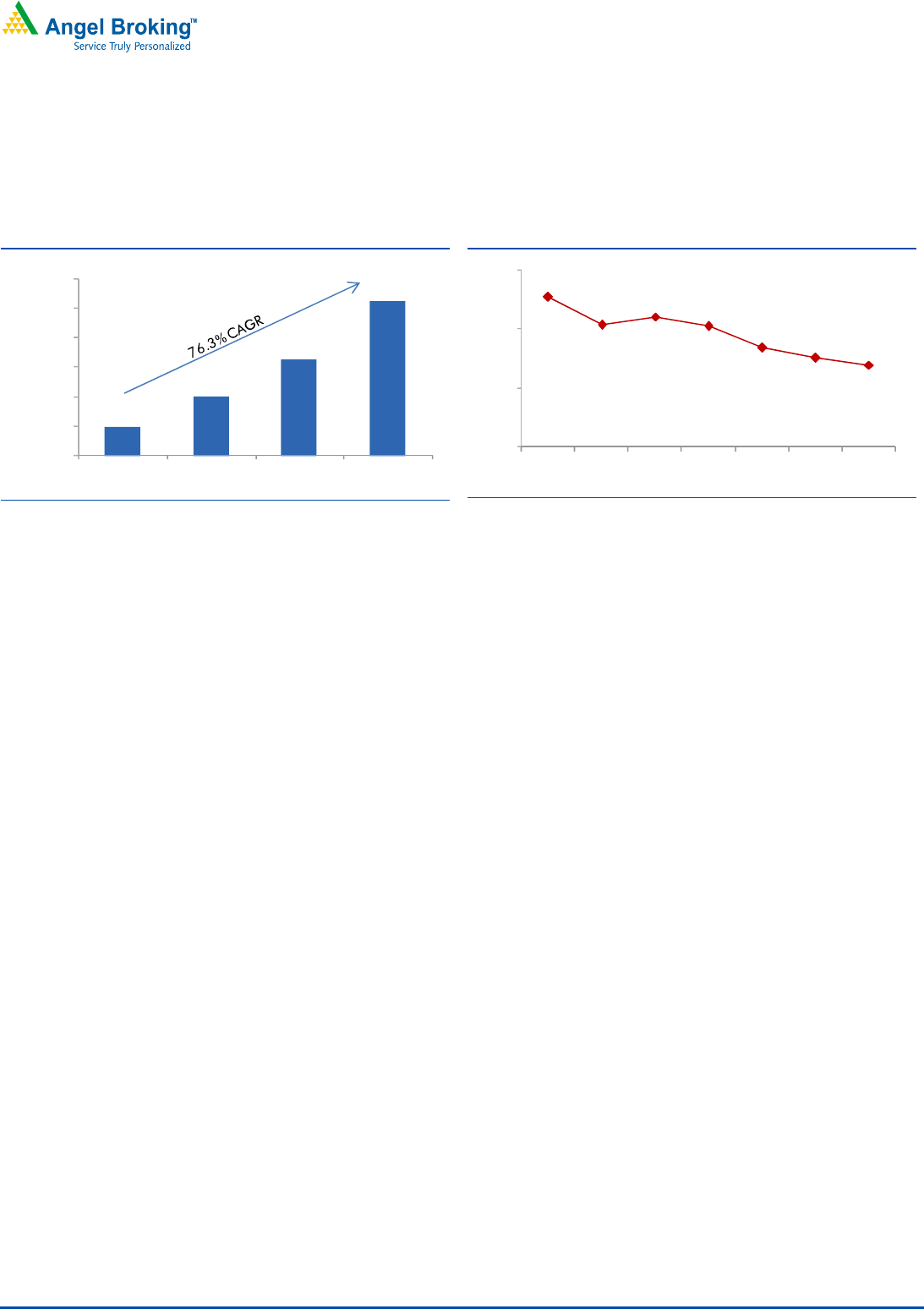

Exhibit 5: Size of organized gold loans market in India

2,500

12,000

25,000

37,500

-

10,000

20,000

30,000

40,000

FY2002 FY2007 FY2009 FY2010

40.3% CAGR

(` cr)

Source: RHP, Angel Research

Exhibit 6: Value of Gold Stock

646,200

1,166,900

2,500,000

3,200,000

-

700,000

1,400,000

2,100,000

2,800,000

3,500,000

FY2002 FY2007 FY2009 FY2010

22.1% CAGR

(` cr)

Source: RHP, Angel Research

NBFCs such as MFL enjoy the highest credit rating from both CRISIL and ICRA for

their short-term debt (AA- rating for long term debt) which enables them to borrow

funds at highly competitive rates and price their lending aggressively compared to

the unorganized sector.

Over the past few years, the organized sector led primarily by the gold loan NBFCs

have grown their market share on the back of a) relatively lower rates of interest

Muthoot Finance

|

IPO Note

A

pril 18, 2011

4

and higher trust factor than unorganized players, b) increasing reach due to rapid

branch expansion, c) fast and convenient service and d) increasing acceptability of

gold loans aided by heavy advertising.

Relatively higher yields

MFL is able to command relatively higher yields as compared to banks due to the

convenience factor. NBFCs like MFL offer flexibility, quick disbursal with minimal

documentation to their customers in return for a premium on the rates of interest

charged. The loan-to-value (LTV) ratio for 22 carat jewelry typically varies from

55-65% by banks while it varies from 70-80% by NBFCs, which may be further

adjusted subject to the purity of gold; this increases the attractiveness of borrowing

from NBFCs compared to banks. As indicated by the management MFL does not

charge any prepayment charges and calculation of interest is also done on the

basis of number of days for which the loan was outstanding, these options offer

flexibility to customers and increase relative appeal of their loan product.

MFLs loan processing time is 5-10 minutes as it relies on its own staff for

verification of purity and weight of gold jewelry. As the customers of MFL are

mainly from lower and lower middle income groups and the loans are usually

taken as bridge financing, the processing time is of paramount importance for the

customers for which they generally do not mind shelling out extra interest. MFLs

average yield on advances is ~20% p.a. compared to ~13% p.a. for banks.

Though the term of loans is 12 months most of the loans get run down in

4-5 months and the average ticket size is just ~`31,500. Hence the extra interest

burden works out to just ~`700-800 which the customers do not mind paying

given the criticality of time. Further the rates charged by MFL are lower than those

charged by the local unorganized moneylenders.

Low credit risks

On the asset quality front, loans given out are over collateralized by a) average

LTV in the lower 70s and b) appraisal of gold jewelry on the basis of scrap value

by ignoring the making charges of the jewelry as well as the weight of precious

stones studded in the jewelry. In addition to this MFL lends only against household

gold jewelry (at or above 20 carat purity only) and not against gold bars. The

household jewelry generally has an emotional and sentimental value attached as it

is generally passed on from generations to generations; this ensures that the loan

is repaid at the first opportunity resulting in minimal credit risks.

Even if a borrower defaults, MFL possesses adequate documentary support for

auctioning the gold collateral in which, according to the management, it has

historically never lost any portion of the principal and has been able to secure

around one-third of the interest income accrued on the loan. This has ensured that

the level of NPAs has been contained at the bare minimum as evident from the

fact that as of November 30, 2010, MFL had a gross NPA ratio of 0.4% and it has

been contained within 0.5% in each of the past three years. Even this NPA level

could have been brought down to zero by selling the pledged jewelry but to ensure

future business and as a good business measure, MFL has been giving an

extension to certain borrowers for 2-3 months beyond the repayment date.

Muthoot Finance

|

IPO Note

A

pril 18, 2011

5

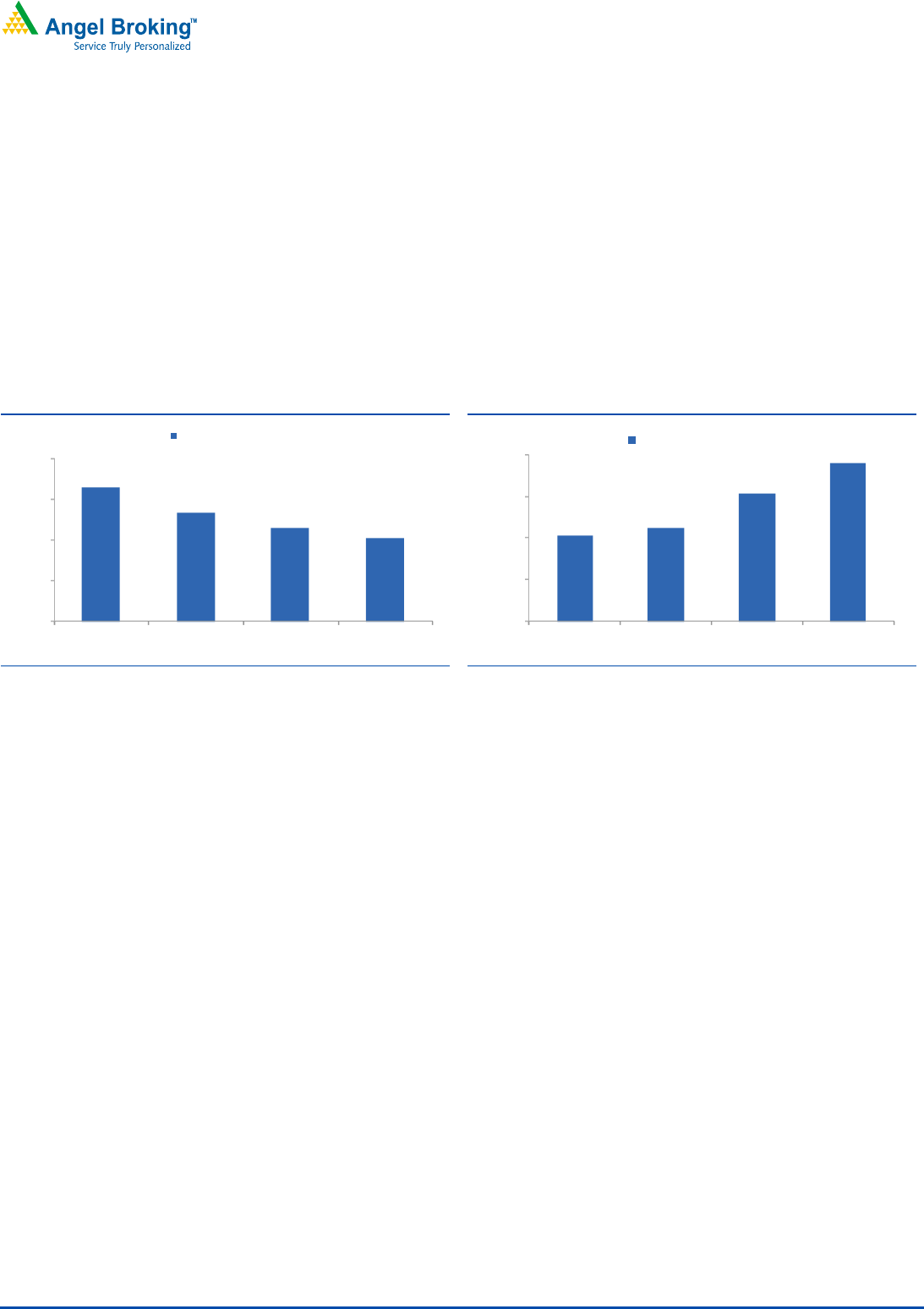

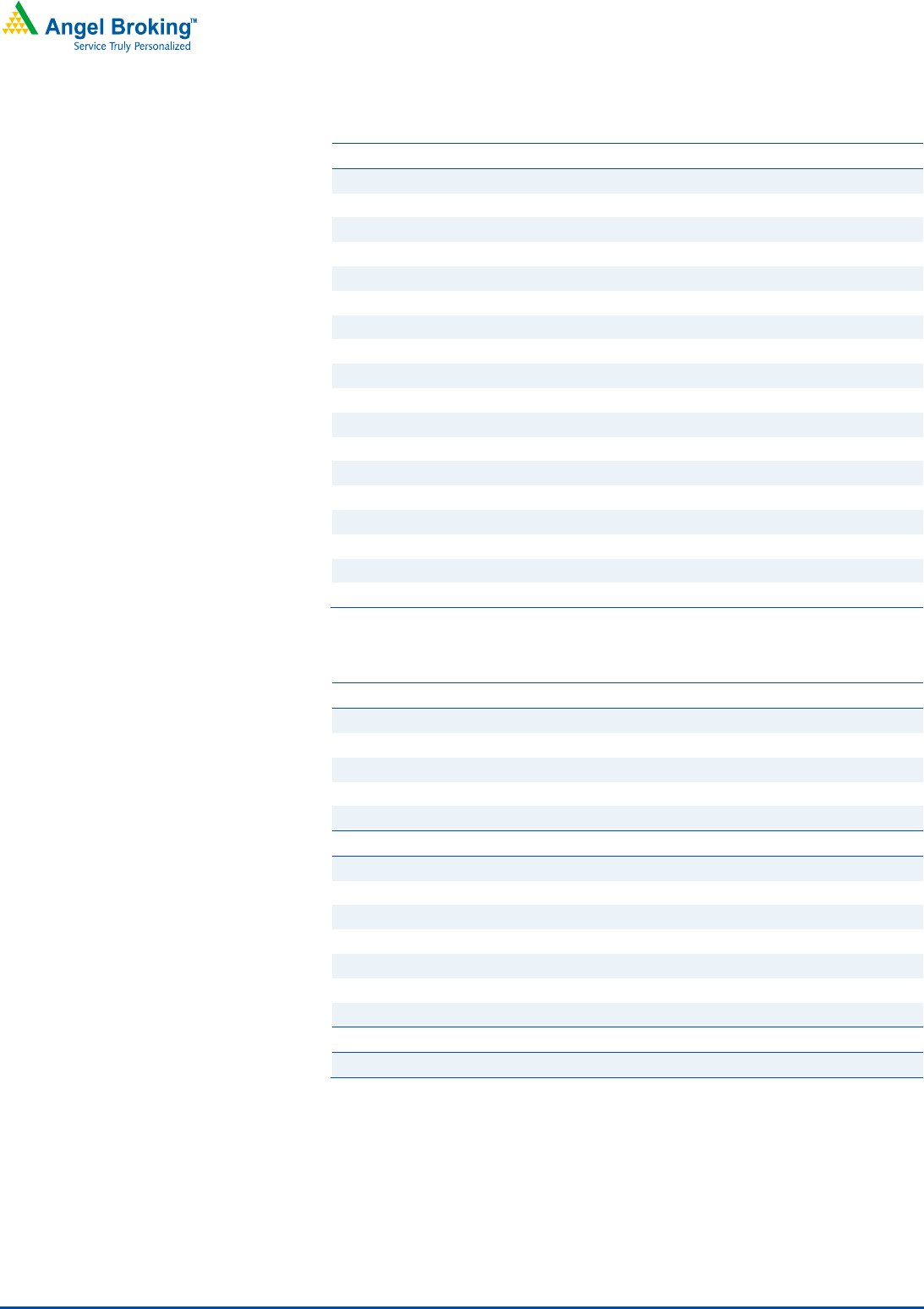

Exhibit 7: NIM moderating due to declining yields

19.5 21.7 19.9 18.9

9.7

10.6

11.2

10.4

8.0

9.0

10.0

11.0

15.0

17.0

19.0

21.0

23.0

FY2008 FY2009 FY2010 8MFY11

Yield on Advances (%) Reported NIM (%, RHS)

Source: RHP, Angel Research

Exhibit 8: Low credit risks

0.42

0.48

0.46

0.35

0.00

0.15

0.30

0.45

0.60

FY2008 FY2009 FY2010 8MFY11

Gross NPAs/Gross Retail Loans (%)

Source: RHP, Angel Research

Strong market share gains

According to the IMaCS Industry Report, the market share of NBFCs in gold loans

has risen from 18.4% in FY2007 to 32.2% in FY2010, at a healthy CAGR of 20.5%

while banks both PSU and private sector banks have lost market share from 52.3%

to 46.5% and from 14.8% to 11.6%, respectively over the same period.

Among the gold loan NBFCs, MFL has continued to be a dominant leader

enjoying ~60% of market share of NBFCs and ~20% (up from ~11% in FY2007)

of the organized gold loan industry (as of FY2010). This healthy growth has been

brought about by focused approach and rapid branch network expansion (42.8%

CAGR over FY2007-10). The pace of branch expansion has been further

accentuated in the 11MFY2011 to 63%, taking the network from 1,605 branches

as of FY10 to over 2,600 branches as of February 2011. This strong branch

expansion is expected to lead to further market share gains for MFL as the

customers generally prefer to transact at the nearest branch.

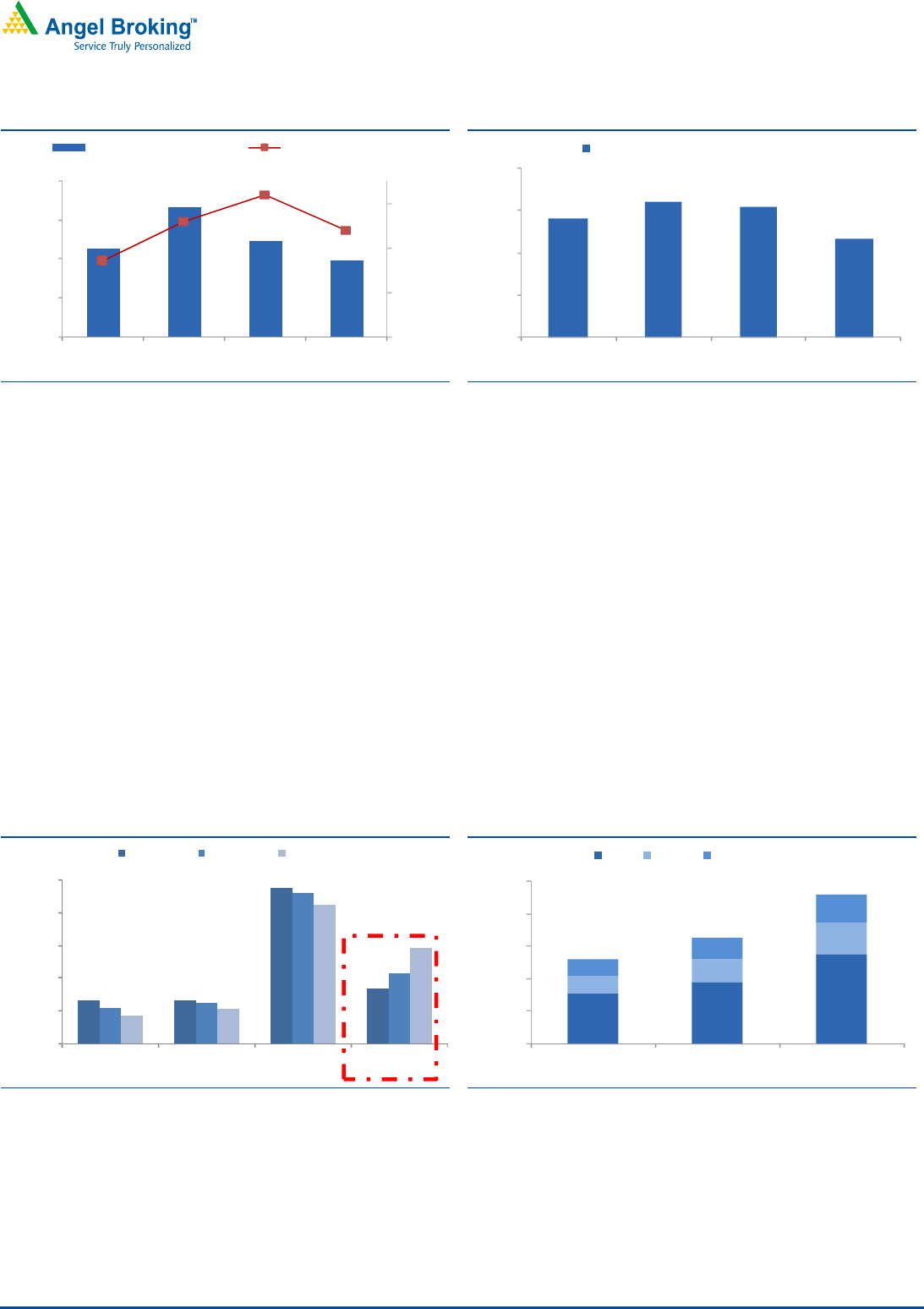

Exhibit 9: NBFCs capturing the market share...

14.5

14.8

52.3

18.4

12.1

13.7

50.6

23.6

9.7

11.6

46.5

32.2

-

11.0

22.0

33.0

44.0

55.0

Co-operatives Pvt Sector Banks PSU Banks NBFCs

FY2007 FY2009 FY2010

(%)

Source: RHP, Angel Research

Exhibit 10: ...led by MFL

11.0

13.4

19.5

3.7

4.9

6.8

3.6

4.8

5.9

-

7.0

14.0

21.0

28.0

35.0

FY2007 FY2009 FY2010

MFL MGFL Muthoot Fincorp

(%)

Source: RHP, Angel Research

The total gold loan AUM (including assignment of receivables) of MFL has

increased from `780cr to `13,004cr at a staggering CAGR of 82.7% over

FY2006-8MFY2011 on the back of 47% CAGR in the number of branches (551 in

FY2007, 2,263 in 8MFY2011). The increase in branch penetration has led to the

AUM per branch increasing from `2.63cr to `5.75cr over the same period.

Muthoot Finance

|

IPO Note

A

pril 18, 2011

6

Competitive strengths

The success of MFL in gold financing has been a play of various competitive

strengths that the company has developed since its inception. A large branch

network of 2,611 branches ably supported by high quality customer service has

created a strong brand image. The company also runs training centers to train

new employees in appraisal skills, customer relations and communication skills. As

the asset quality is critically based on the sanctity of the purity and weight

verification process, MFL has set up training centers for building a talent pool to

enable the company to staff new branches with qualified and skilled personnel.

The training has also helped in shortening the turnaround time for loan disbursals.

Loan of an average ticket size is appraised and disbursed in under 5 minutes by

the company. Quick disbursal with minimal documentation provides a competitive

edge against commercial banks that provide gold loans.

Capital adequacy to be strengthened further post IPO

Post IPO, MFL will be well positioned for the next phase of growth. As of

9MFY2011, the CRAR stood at 15.2% with a Tier- I CRAR of 10.7%. Post capital

infusion though the IPO, the Tier-I ratio is expected to jump to ~21% compared to

the mandatory requirement of 15% by the Reserve Bank of India, making the

company well-capitalized to increase its gold AUM at a CAGR of 37.3% in

FY2011E-FY2013E. The risk-weightage prescribed by the RBI on loans against

gold given out by NBFCs is 100% while for the gold loans for agri disbursed by

banks is only 50%. If this apparent regulatory inconsistency is normalized in the

future, gold financing NBFCs are expected to grow even faster and is likely to lead

to aggressive market share gains for them.

Exhibit 11: Well positioned for the next phase of growth

10.5

10.6

12.5

9.9

11.1

16.5

15.7

2.6

2.0

3.8

4.9

4.0

4.3

4.8

13.1

12.6

16.3

14.8

15.1

20.8

20.5

0.0

4.0

8.0

12.0

16.0

20.0

24.0

FY07 FY08 FY09 FY10 FY11E FY12E FY13E

Tier 1 CAR (%) Tier 2 CAR (%)

S

ource: RHP, Angel Research

Aggressive expansion into other regions to reduce concentration

risks

As most of India’s gold holding is concentrated in south India (~40%), 75.4% of

AUM for MFL comes from the southern region. While the gold holdings are

relatively lower in western and northern regions (~25% each), the combined AUM

in these regions is just above 22%, highlighting the cultural averseness in pledging

Muthoot Finance

|

IPO Note

A

pril 18, 2011

7

gold. With the southern market also being heavily competed for by other major

market players such as MGF, IOB and Indian Bank, MFL has been aggressively

expanding in northern and western regions. During FY2008-11MFY2011, the

company opened 409 branches in the northern region (106.6% CAGR) and 256

branches in the western region (97.2% CAGR). The AUM over FY2008-8MFY2011

grew by 98.4% CAGR in the northern region to 1,811cr and 146.6% CAGR in the

western region to `1,036cr. The company opened 1,151 branches in the southern

region in FY2008-11MFY2011 at 44.3% CAGR leading to a more than double

89.0% CAGR growth in AUM to `9,709cr, highlighting the importance of brand

building in attaining higher branch penetration and the potential to do the same in

the other regions of India.

Exhibit 12: Region-wise AUM per Branch (FY2010)

4.9

4.0

3.5

3.1

-

1.5

3.0

4.5

6.0

Southern India Northern India Western India Eastern India

AuM/Branch (` cr)

Source: RHP, Angel Research

Exhibit 13: Optimisation of branch network

3.1

3.4

4.6

5.7

-

1.5

3.0

4.5

6.0

FY2008 FY2009 FY2010 8MFY11

AuM/Branch (` cr)

Source: RHP, Angel Research

While MFL’s branches and consequently business have been concentrated in the

southern region, the management has aggressively expanded into all the three

remaining regions over the past 3 years with a view to reduce the concentration

risks and grab the opportunities in the other regions as well. MFL has opened

~40% of the incremental branches during FY2008-11MFY2011 in the northern,

western and eastern region which accounted for just 15% of the total branch

network as of FY2008. As a result, proportion of southern region in the

incremental loans during FY2008-8MFY2011 has reduced to ~74% from over

82% of the total loan book as of FY2008.

MFL has grabbed the first mover advantage primarily in the northern region with

setting up of 548 branches (~20% of total branch network) compared to just

177 branches (~9% of total branch network) of MGF in the northern region. This

aggressive expansion into other regions is expected to help the company to reduce

the dependence on the southern region and open up further growth avenues for

MFL, going forward.

Better operating efficiency compared to MGF

Operating costs for gold financing NBFCs are high given the granularity of the

disbursals (average ticket size of ~`31,500). Gold financing NBFC is a

labour-intensive business requiring recruitment at large scale. In the month of

February, 2011, MFL served an average of ~68,000 customers per day through

its extensive network of 2,611 branches and an employee base of over 15,600

employees. However amongst MFL and MGF, MFL enjoys a competitive edge with

Muthoot Finance

|

IPO Note

A

pril 18, 2011

8

operating costs to average assets ratio of 4.1% compared to MGF’s 6.2% during

FY10. Even these are expected to normalize downward, as the business

starts reaping benefits of economies of scale and provide some cushion against

falling yields.

Exhibit 14: Strong increase in employee base

2,999

5,979

9,745

15,664

-

3,000

6,000

9,000

12,000

15,000

18,000

FY2008 FY2009 FY2010 11MFY11

Source: RHP, Angel Research

Exhibit 15: Operating efficiency to continue

5.1

4.2

4.4

4.1

3.4

3.0

2.8

0.0

2.0

4.0

6.0

FY07 FY08 FY09 FY10 FY11E FY12E FY13E

Note: RHP, Angel Research; Note: Opex to avg. assets (%) incl. bilateral assignments

Investment concerns

Regulatory risks

Since the entire model of NBFCs is relatively new to the Indian economy,

regulations concerning them have changed frequently and are bound to do so in

the near future. The agri-gold loans given by banks to gold loan financing NBFCs

by purchasing their receivables, until recently were accorded agricultural priority

sector status. However, on February 3, 2011 the Reserve Bank of India has

removed this status leading to a likely negative impact on the entire sectors

profitability. The priority sector funds used to come at a cost of ~200bps lower

than normal bank borrowings. Although the major source of funding for MFL is

working capital loans (38% as of FY2010) and proceeds from issuance of Non

Convertible Debentures also known as Muthoot gold bonds (27% as of FY2010),

borrowings by assigning receivables also contributes significantly to the funding

mix (26% as of FY2010). Taking into account the normal bank borrowings that

would also be affected by this rule, the total effect of the regulatory change would

be on ~37% of the funding mix. Hence, we expect the increased cost of bank

borrowings to affect the NIMs negatively by ~60bps.

Also, according to RBI’s draft guidelines (June 2010) loan issuers would be

required to hold loans for a minimum period of 12 months (on a maturity of up to

24 months) before being able to securitise their loans. If these guidelines are

implemented in future and were to apply to bilateral assignments also, it would

restrict the funding through assignment of receivables for MFL as the maximum

loan duration for the company is 12 months. MFL would then have to rely on

normal bank borrowings which would have higher costs attached.

Interest rates charged by MFL on gold loans range from 12% to 30% per annum

depending on the LTV with an average yield of ~19% for 8MF20Y11. Although,

currently the gold loan NBFCs are regulated by RBI, some state governments

require compliance by the NBFCs with relevant state money lending statutes. One

of the technical committees set up by RBI recently recommended that NBFCs

Muthoot Finance

|

IPO Note

A

pril 18, 2011

9

should not come under state money lender’s act, however if the state governments

have their way, it would lead to capping of interest rates which could adversely

affect the margins of MFL. The Kerala Money-Lenders Act, 1958 requires interest

rates to be capped at 2% higher than the maximum rate of interest charged by

commercial banks on loans granted by them.

The Malegam committee recently had recommended capping of interest rates at

24% for MFIs, bearing in mind that the target market for MFIs are low income

individuals or households. Gold financing NBFCs also have been subject to such

scrutiny in past and considering that most of their customers also belong to the low

income group, any future regulatory measures requiring capping of interest rates

for MFIs could also apply to gold loan financing NBFCs.

Business growth and asset quality directly linked to gold prices

One of the core drawbacks of specialized lending is that the business risk is

entirely coupled to either the specific sector or the target market. In case of

Muthoot finance the risk is entailed in the prices of collateral.

The growth for both MFL and MGF has largely been in the last 4-5 years, a period

where gold prices increased consistently. The volume growth (gold pledged) over

the FY08-8MFY11 has been 56.1% CAGR, while the Gold AUM growth over the

same period has been higher at 95.1% CAGR , implying that ~25% CAGR growth

in AUM has been due to the rise in gold prices keeping the LTV ratio constant.

Assuming, over the same period, if the volumes would have grown at the same

rate of 56.1% CAGR, but the gold prices would have declined by 25% CAGR, the

growth in AUM would have been only ~17% CAGR. Considering that higher gold

prices lead to higher pledging of gold and hence higher volumes, any significant

drop in gold prices would not only lead to decline in AUM growth rate but also a

decline in the volume growth rate. Also once the price of the collateral drops below

the loan proceeds, delinquencies would also start rising.

However, although not fully insulated, the sector has several safeguards to absorb

the impact of a sharp decline in gold prices. The loan to value ratio (LTV) for MFL

is between 60%-85% giving it a cushion against ~15% drop in gold prices.

Moreover the collateral is appraised solely based on the weight of the gold content

while the production and design costs and the costs associated with additional

gems studded into the jewelry are excluded, providing further cushion of ~5-10%

(as indicated by the management, though in our view it is unlikely that in any

auction, the lender would be able to recover anything more than the scrap value).

Another advantage which plays into the hands of the company is the emotional

quotient attached with the family jewelry that is pledged by the borrowers. The

tenure of all gold loans for MFL is 12 months, however on an average repayments

occur between 90 and 180 days. MFL also possesses the right to sell off the

collateral even before a loan becomes past due in the event the market value of

the underlying collateral becomes less than the amount outstanding on the loan.

Muthoot Finance

|

IPO Note

A

pril 18, 2011

10

Increase in competition from other players

Banks have a funding advantage versus NBFCs given the access to low-cost fixed

rate funding in the form of current account and savings account (CASA) balances.

Hence, they can afford to compete on pricing and try to take market share.

However, since ~75% of the total market is with the unorganised money lenders

and pawnshops and NBFCs are targeting customers that usually don’t have access

to bank finance or have a very urgent need, the potential offered by this sector for

organized players such as MFL is still reasonably large. However, that said, due to

the attractive ROEs currently being offered by the sector, other NBFCs have also

started entering this segment. In light of expected increase in competition, we have

factored in a drop in NIMs from 11.1% in FY2010 to 8.2% in FY2013E.

Muthoot Finance

|

IPO Note

A

pril 18, 2011

11

MFL vs. MGF

Exhibit 16: Competitive advantage analysis

MFL

MGF

Business growth

AUM growth (FY2008-9MFY2011, %) $ 93.8

115.4

Market share (FY2010, %) 19.5

6.8

Branches (9MFY2011) 2,263

1,795

Asset quality

Net NPAs (9MFY2011, %) $ 0.4

0.1

Credit cost (FY2010, %)* 0.0

0.6

CAR (9MFY2011, %) 15.2

32.5

Cost ratios

Opex to average assets (FY2010, %)* 4.1

6.2

Cost to Income ratio (FY2010, %) 43.4

66.3

Profitability ratios

NII growth (FY2008-FY2010, %) 84.1

129.7

PAT growth (FY2008-FY2010, %) 91.6

182.8

ROA (FY2010, %)* 3.5

5.1

NIM (FY2010, %)* 11.1

15.2

Valuation ratio

P/ABV (FY2013E) 1.8

1.8

Source: RHP, MGF, Bloomberg, Angel Research ; Note: $8MFY11 for MFL, * Calculated on total

assets including bilateral assignments

Exhibit 17: MFL enjoys ~3x MGF’s market share as of FY10

11.0

3.7

13.4

4.9

19.5

6.8

-

5.0

10.0

15.0

20.0

25.0

MFL MGFL

FY2007 FY2009 FY2010

(%)

Source: RHP, Angel Research

Exhibit 18: Branch growth of MGF higher than MFL

551

291

707

436

985

645

1,605

1,005

2,263

1,795

-

500

1,000

1,500

2,000

2,500

MFL MGFL

No. of branches

FY2007 FY2008 FY2009 FY2010 9MFY11

45.8% CAGR 62.4% CAGR

Source: MGF, Angel Research

Muthoot Finance

|

IPO Note

A

pril 18, 2011

12

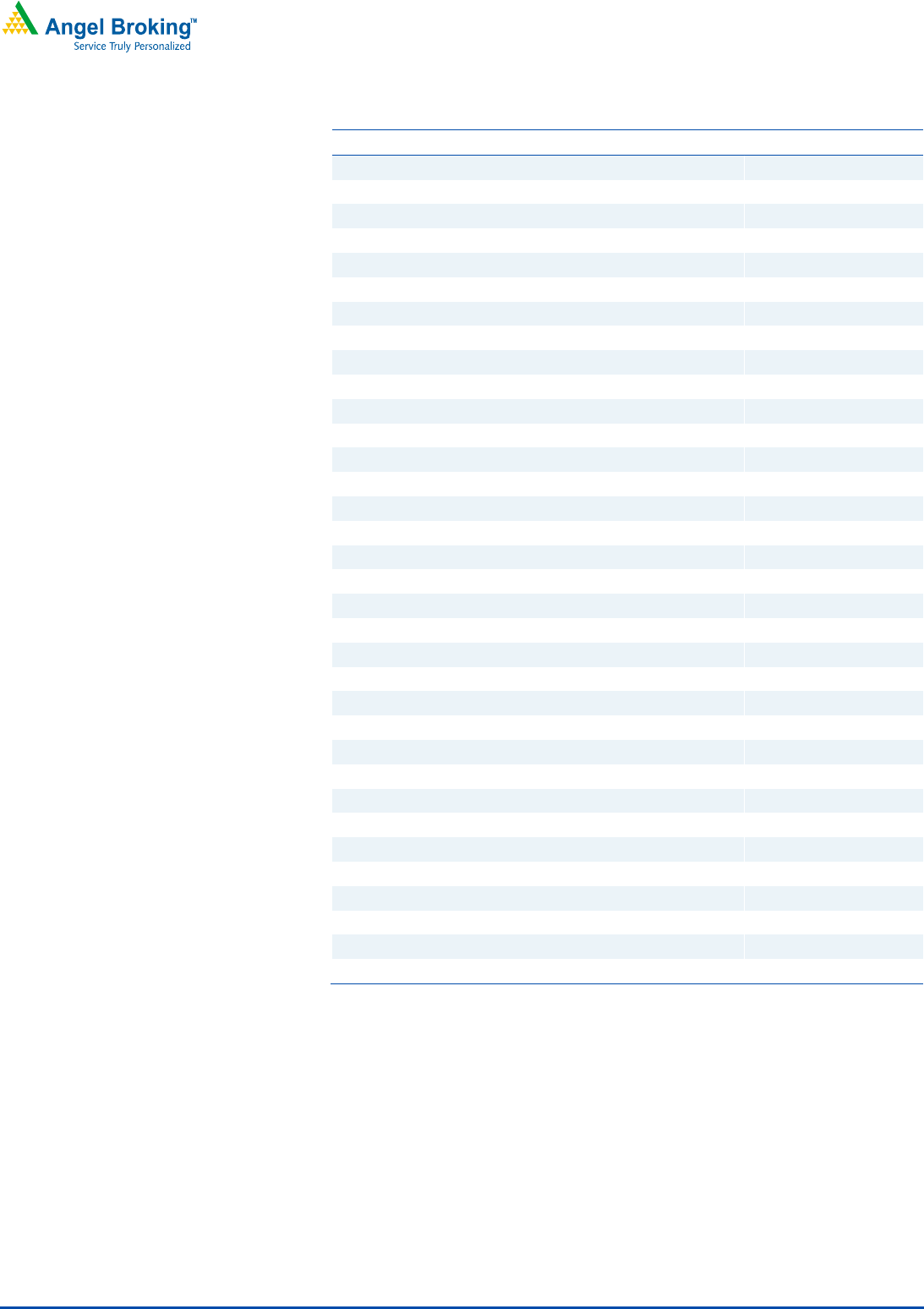

Exhibit 19: MFL – retail NCDs a stable base of funding

WC Loans

38%

NCDs

27%

Assignment

26%

Others

1%

Sub. Debt

4%

CP

4%

Source: RHP, Angel Research; Note: as of 8MFY2011

Exhibit 20: MGF – more reliance on bank funding

WC Loans

62%

Assignment

26%

NCDs

5%

Sub. Debt

5%

CP

2%

Source: MGF, Angel Research; Note: as of 9MFY2011

Outlook and valuation

While gold loan NBFCs like MFL have seen highly profitable growth so far, this has

occurred in an environment of consistently rising gold prices. Any sharp decline in

gold prices could pose downside risks to growth and asset quality. Moreover,

recent developments regarding lending to relatively low-income segments have

highlighted regulatory risks to MFL’s business from any regulatory capping of its

currently high yields (~19% in 8MFY2011). That said, post-correction, MFL’s

closest competitor Manappuram (MGF) is trading at 1.8x FY2013E BV (Bloomberg

consensus) and MFL has been priced equivalent to MGF’s valuations at the upper

end of the price band. Considering the reasonably high growth potential and

profitability, we expect moderate upsides at the upper band, also taking into

account MFL’s higher market share than MGF, better operating efficiency, higher

leverage and a more extensive pan India branch network. Hence we recommend a

Subscribe to the issue at the upper price band.

Muthoot Finance

|

IPO Note

A

pril 18, 2011

13

Income statement

Y/E March (` cr) FY07

FY08

FY09

FY10 FY11E FY12E

FY13E

Net Interest Income 124

178

296

604 1,173 1,831

2,196

- YoY Growth (%) 58.6

44.0

66.4

103.6 94.4 56.0

19.9

Other Income 10

11

14

12 14 16

19

- YoY Growth (%) 98.3

3.1

32.4

(15.8) 18.1 16.7

17.5

Operating Income 134

189

311

616 1,188 1,847

2,215

- YoY Growth (%) 61.1

40.9

64.5

98.2 92.9 55.5

19.9

Operating Expenses 67

92

162

267 447 671

839

- YoY Growth (%) 59.5

36.5

76.3

65.2 67.5 50.0

25.0

Pre - Provision Profit 67

97

149

349 740 1,176

1,376

- YoY Growth (%) 62.6

45.2

53.4

133.9 112.3 58.9

17.0

Prov. and Cont. 0

1

1

2 36 26

35

- YoY Growth (%) 70.5

821.3

(0.9)

206.3 1,598.0 (27.2)

33.7

Profit Before Tax 67

96

148

346 705 1,150

1,341

- YoY Growth (%) 62.6

44.3

53.8

133.6 103.3 63.2

16.6

Provision for Taxation

23

33

50

118 234 373

435

- as a % of PBT 34.4

34.6

34.0

34.0 33.2 32.4

32.4

PAT 44

63

98

229 471 777

906

- YoY Growth (%) 63.1

43.8

55.2

133.5 105.9 65.1

16.6

Balance sheet

Y/E March (` cr) FY07

FY08

FY09 FY10 FY11E

FY12E

FY13E

Share Capital 5

5

49 301 320

372

372

Reserve & Surplus 154

208

312 283 990

2,574

3,415

Net Borrowings 1,383

1,915

3,166 5,281 12,001

17,416

23,523

- Growth (%) 71.6

38.5

65.3 66.8 127.3

45.1

35.1

Other Liabilities & Provisions 67

156

231 572 1,055

1,268

1,691

Total Liabilities 1,609

2,285

3,758 6,436 14,366

21,630

29,000

Investments 24

18

9 8 8

8

8

Gross Advances (AUM) 1,470

2,238

3,385 7,466 16,053

23,276

30,259

less : Assignment of receivables

81

434

813 2,008 3,670

4,524

4,998

Net Advances 1,389

1,804

2,572 5,458 12,382

18,753

25,261

- Growth (%) 74.8

29.9

42.6 112.2 126.9

51.4

34.7

Fixed Assets 63

109

129 153 271

392

510

Other Assets 132

354

1,049 818 1,706

2,477

3,222

Total Assets 1,609

2,285

3,758 6,436 14,366

21,630

29,000

- Growth (%) 71.1

42.0

64.5 71.3 123.2

50.6

34.1

]

Muthoot Finance

|

IPO Note

A

pril 18, 2011

14

Ratio Analysis

Y/E March FY07

FY08

FY09 FY10 FY11E

FY12E

FY13E

Profitability ratios (%)

NIMs* 10.9

9.6

10.5 11.1 10.0

9.3

8.2

Cost to Income Ratio 50.1

48.6

52.0 43.4 37.7

36.3

37.9

RoA* 3.3

2.9

2.7 3.5 3.6

3.5

3.0

RoE 35.1

33.9

34.1 48.3 49.7

36.5

26.9

B/S ratios (%)

AUM/ Gross borrowing 100.4

95.3

85.1 102.4 102.4

106.1

106.1

CAR 13.1

12.6

16.3 14.8 15.1

20.8

20.5

- Tier I 10.5

10.6

12.5 9.9 11.1

16.5

15.7

Asset Quality (%)

Gross NPAs* 0.2

0.4

0.5 0.5 0.5

0.5

0.6

Net NPAs* 0.1

0.4

0.4 0.4 0.4

0.5

0.5

Loan Loss Prov./Avg. Assets*

0.0

0.0

0.0 0.0 0.0

0.0

0.1

Provision Coverage 10.0

10.0

10.0 10.8 11.0

15.0

20.0

Per Share Data (`)

EPS 2.0

2.9

3.9 7.6 14.7

20.9

24.4

ABVPS (75% cover. NPAs) 4.6

6.7

7.1 10.2 18.7

39.4

77.2

DPS -

-

- - -

1.0

1.5

Valuation Ratios

#

PER (x)

86.2

59.9

45.1 23.1 11.9

8.4

7.2

P/ABVPS (x)

26.3

24.7

17.2 9.4 4.4

2.3

1.8

Dividend Yield -

-

- - -

0.6

0.9

DuPont Analysis (%) *

NII 9.4

8.1

8.1 9.3 8.9

8.3

7.3

(-) Prov. Exp. 0.0

0.0

0.0 0.0 0.3

0.1

0.1

Adj NII 9.4

8.0

8.1 9.2 8.6

8.2

7.2

Other Inc. 0.8

0.5

0.4 0.2 0.1

0.1

0.1

Op. Inc. 10.2

8.5

8.5 9.4 8.7

8.2

7.2

Opex 5.1

4.2

4.4 4.1 3.4

3.0

2.8

PBT 5.1

4.4

4.1 5.3 5.3

5.2

4.5

Taxes 1.7

1.5

1.4 1.8 1.8

1.7

1.4

ROA 3.3

2.9

2.7 3.5 3.6

3.5

3.0

Leverage 10.5

11.8

12.7 13.8 14.0

10.4

8.9

ROE 35.1

33.9

34.1 48.3 49.7

36.5

26.9

Note;

#

Valuations at the upper price band, * Calculated on total assets including bilateral assignments

Muthoot Finance

|

IPO Note

A

pril 18, 2011

15

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report

.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.